Follow up to pensions & death Online Assembly

richallum

Administrator

richallum

Administrator

This was a really good session featuring @les_cameron and included some excellent spreadsheets and tables. If you want to watch it, you can here.

We didn't have time to get through all the questions and Les has offered to answer them here. If you have any more please add them as a comment.

**Q1: **The biggest issue with the new rules is that beneficiaries could be double-taxed, since the pension pot would have already been taxed for IHT (in some cases). Is my understanding correct on this? and does being paid in cash rather than inherit the pension, avoid that issue (post 75)?

Q2: How do we feel about taking regular pension income now to give away as normal gifting from income so it's

outside the estate immediately, rather than after 7 years? Any issues with this? What if you are drawing

down the pension very quickly within a few years to give it away?

Q3: Do you think there will be a consideration for single people as they do not have partners to pass their pots to

so they have to pass their pensions to other people?

Q4: Do you think it would be possible to invest pension assets into AIM or BR qualifying shares when in ill health without falling foul of the 2 year rule?

Paraplanner. F1, Apple, Nutella, ice cream. No trite motivational quotes. Turning a bit northern.

Comments

Q1 - the intent is that IHT will be paid then the balance will go through the pension tax system as we know it. Being paid a lump sum or an income will not change it, it's just the lump sum will have all the income tax hit in one go.

I know there is a lot of hysteria about double taxation but if you think about it the contributions avoided tax (and NI) and the income tax was deferred - so it's really the undeferring of your tax.

If £100 went to an ISA from your relevant earnings instead of your pension for a HRT they would have £60 in their ISA then get IHT - is that double taxation?

Q2 - there has definitely been a lot of interest in this and an exempt gift for IHT purposes is always better than a potentially exempt one. Note for the NEOOI exemption to apply there has to be an established pattern and that has to be at least 3 or 4 years.

Q3 - not sure what is being asked. But single people will have potential IHT issues with their pension the same way they would with there non pension assets - it's kind of business as usual maybe? With a different tax outcome.

Q4 if you mean in the pension scheme then it's not clear you would qualify for BR in the pension. I think it needs a change of law for pension schemes to claim it. So that's a wait and see. In principle it is a change to pension intended to confer a gratuitous benefit on someone else so HMRC might well not look favourably on it (as they might not making a withdrawal to buy BPR outside the scheme.)

Great presentation @les_cameron thank you.

Just to confirm the powerful slide about taking £100k from a pension and placing it somwhere else. I guess that theory only works on PCLS from a pension, otherwise £100k would instantly only be £60k, have I understood that right?

And if so, how to do the numbers stack up with taxable income from a pension?

Yes PCLS or beneficiary drawdown where the previous member died pre 75.

Build a spreadsheet!!!

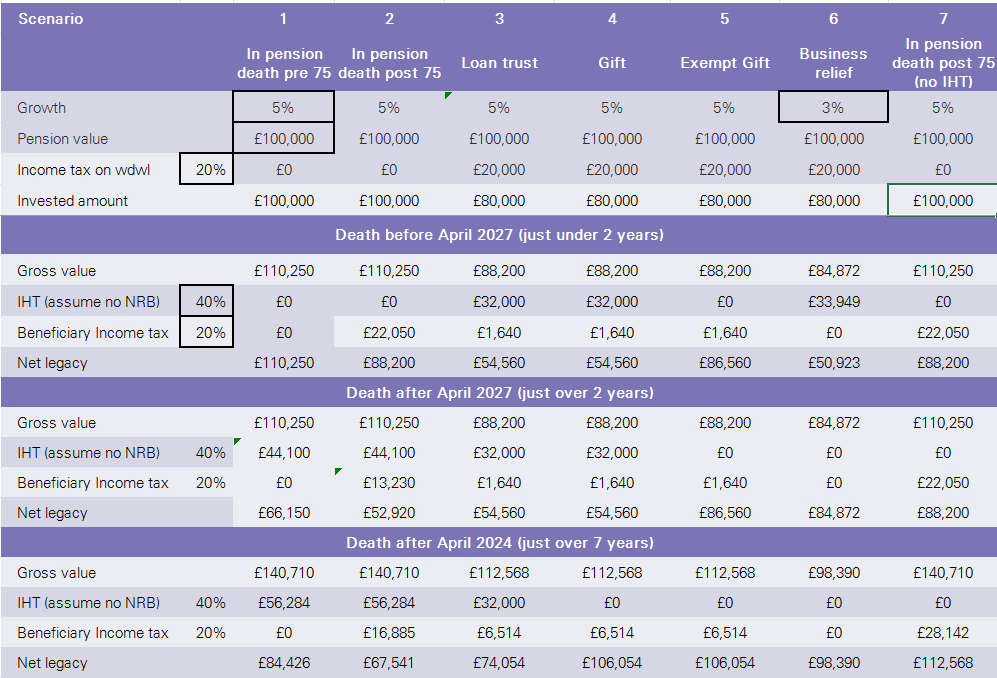

Here's out at 20% with 20% beneficiary

Ignore above - wee error in scenario 7