Tax Free cash, LTA and Protection

Nathan

Member

Nathan

Member

Hi All

I am getting myself in a bit of a muddle with all the changes and the provider we are dealing with is not being overly helpful.

We had a client with total pension fund of £1,281,839 and he took PCLS in December 2023 and received £268,275 based upon LTA of £1,073,100.

We saw him in September 2024 and he said ‘Did I ever mention I have Fixed Protection 2016?’ and gave me a copy of his certificate showing LTA of £1,250,000. (FP certificate is dated 2017)

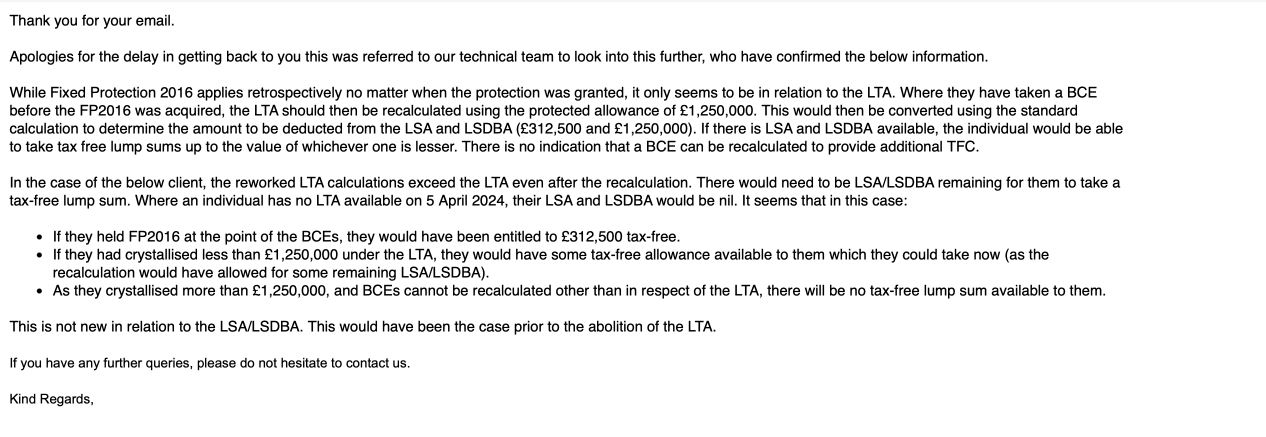

I sent it to the pension company and asked them to recalculate but it’s gone backwards and forwards for months, with no outcome and they have sent me an email which makes little sense at all:

Can anyone shed any light on the position as the email seems to contradict itself, one minute suggesting the client could have it and the next saying they cant.

Any assistance would be greatly appreciated.

N

Comments

Hi Nathan

Hope you are well.

So did they crystallise £1,073,100 or did they crystallise 100% of the pension in December 2023?

Nathan

Although I agree its confusing what they have come back with and seems to contradict. Hopefully Les will read this and clarify it all. I'm guessing they won't be allowed anything further though if they are saying they can't recalculate a BCE. Perhaps they meant on the first bullet point that if they had registered the FP with the provider at the point of BCE they could have obviously had the higher amount, rather than how it reads, i.e the client actually just holding FP.

The correspondence suggest they crystallised the full £1.28m - if that's the case then they used 100% of the protected LTA. So no more TFC.

If they only crystallised £1,073,100 then the scheme is talking mince they should be treated as only having used 1,073,100 / 1.25m and should have more TFC available..

I'm willing to bet it's the former and someone thought it would be a good idea to fully crystallise above the protected amount "in case Labour brought the LTA back". And has done their client out of some tax free cash by giving advice based on uncertain rules and media speculation.

Thank you @les_cameron and @Nath

@Nathan @Nath

I just read this again - they could get more TFC if they are still eligible for a TTFAC.

The LSA usage on the default basis would be £312,500 (as over 100% LTA usage) but they only got £268,275 meaning a TTFAC is in scope.

@les_cameron Aegon are saying that because the whole fund was crystallised to pay the £268,275, rather than just £1,073,100, they cant do anything. Is that correct?

It is correct unless they get a TTFAC and then they are wrong.

https://www.mandg.com/wealth/adviser-services/tech-matters/pensions/benefit-limits/transitional-tax-free-amount-certificates

@les_cameron Thank you