Tax on bond surrender - onshore

Hi everyone,

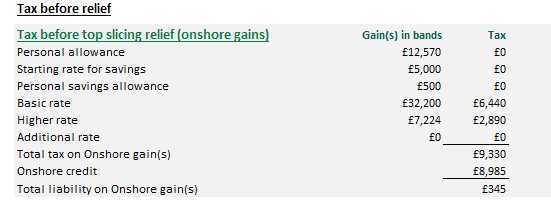

I'm calculating the income tax due on an onshore bond gain of £57,494 for a client with no income. I've used the Quilter calculator which has given me the calculation shown in the attached image.

Why is the onshore credit not 20% x £57,494 = £11,499 (capped at £9,330 as that's the amount of tax due on the gain)? I've read a couple of articles online to try and understand what's going on here but I'm still not really understanding. It looks like the onshore credit of 20% has been calculated as 20% x £44,924 (the amount of the gain less the amount that falls into the personal allowance) so I'm suspecting that has something to do with it.

Thanks!

Comments

I believe that (in simple terms) you can not have a tax credit against income which is not taxable. As the PA is being used here in full you don't get the tax credit on that amount.

(As an aside, the £345 tax liability is before top slicing relief; with top slicing (of 2 yrs or more) the tax liability falls to £0.)

Yes, you only get credit for that part of the gain which is outside personal allowance.

And tax should be £0