Share options taxation

Chris_Hindle1

Member

Chris_Hindle1

Member

Does anyone have a good understanding of share option taxation?

A client is due to receive several £m in the coming weeks as her former company IPO's. She holds vested unapproved share options, which she intends to convert to Class A shares and sell immediately at IPO.

I'm unsure about one aspect of the taxation:

Employer NI, will she be responsible for paying employer NI? If so, is the gain on which she pays the employer NI deductible against income tax and employee NI?

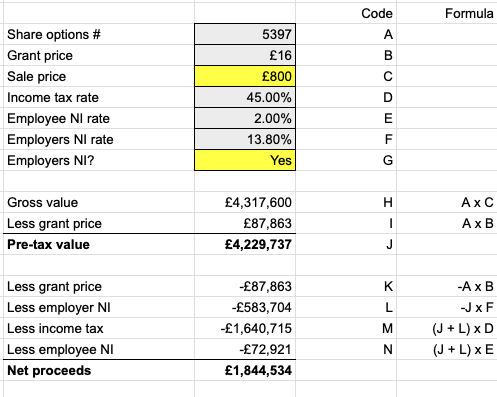

A copy of my workings is attached. Note that funding for the grant price as well as taxes/NI will be deducted by withholding/selling shares (cashless exercise).

Any help greatly appreciated!

Comments

My understanding is that the employer can force the employee to pay ER NI, so I think it depends what the agreement is between the two?

Thanks @arongunningham - the employer will transfer the NI liability to the employee.

Do you know if the gain on which she pays the employer NI is deductible against income tax and employee NI?

This link suggests that it is deductible for income tax purposes: https://techfocus.taylorwessing.com/legalhowto/options/uk-non-tax-favoured-share-options/#exercise-of-option-national-insurance-contributions-nics