RO2 question query

in CPD & Exams

Hi,

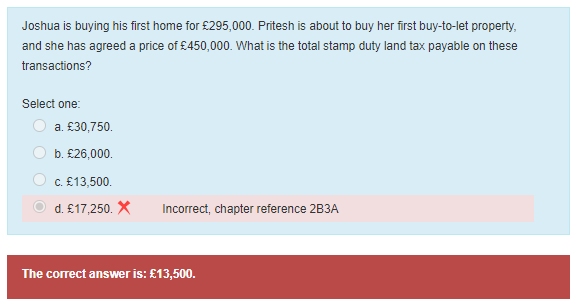

I just can't seem to get my head around the below question. Could someone please explain the calculation behind it as I can't seem to work it out.

Thanks in advance

Comments

There's no stamp duty on Joshua's purchase as he is a first time buyer and it's below the £300,000 threshold, so it's just £13,500 from Pritesh's purchase if you can try work that out.

EDIT: I've tried a few times and can't get £13,500 actually so I can't help I'm afraid.

I can only assume that this question is based on the COVID-19 temporary stamp duty rates. In which case it's just the 3% surcharge on the full value of the BTL. £450,000 x 3% = £13,500.

A bit sneaky that. Worth checking what rates the exam questions will be based on.