RO2 question query

in CPD & Exams

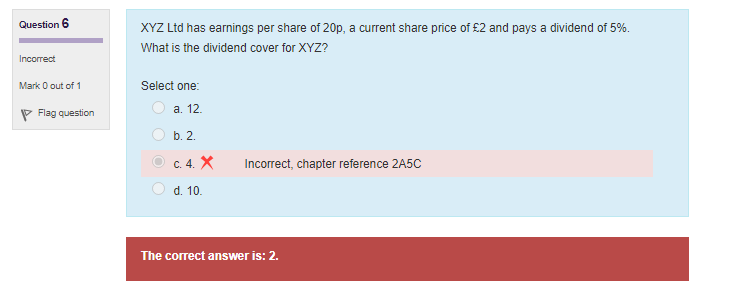

Hi all, wonder if anyone can help, i cant for the life of me get my head around this answer and cant find the revision mate forums anymore (have they been removed?) could someone confirm how i get to the below answer please? based on the book the dividend cover is Earnings per share / Dividends per share, I have used the 5% as the DPS as they haven't given me a number of Ordinary shares to work out an alternative DPS amount... I'm completely stuck!

Comments

Hi,

Try this link for a basic breakdown:

https://brandft.co.uk/4-investment-ratio-calculations-you-need-to-master/

Hi, thank you for this, still a little confused, the link states - EPS divided by the dividend per share which is as I though, so 20/5 = 4

I'm not sure if I'm missing something? I cant work out a pence price for the dividend as I don't have a number or ordinary shares in issue

I work it out as:

earnings per share 20p

share price £2

dividend per share 5% of £2 = 0.10p

the dividend cover = Earnings per share (20p) divided by the dividend per share (10p)

share price of £2 or 200p *5% for dividend = 10p

20p earnings per share / 10p dividend per share = dividend cover of 2

thank you, not really sure why i couldn't figure that out!